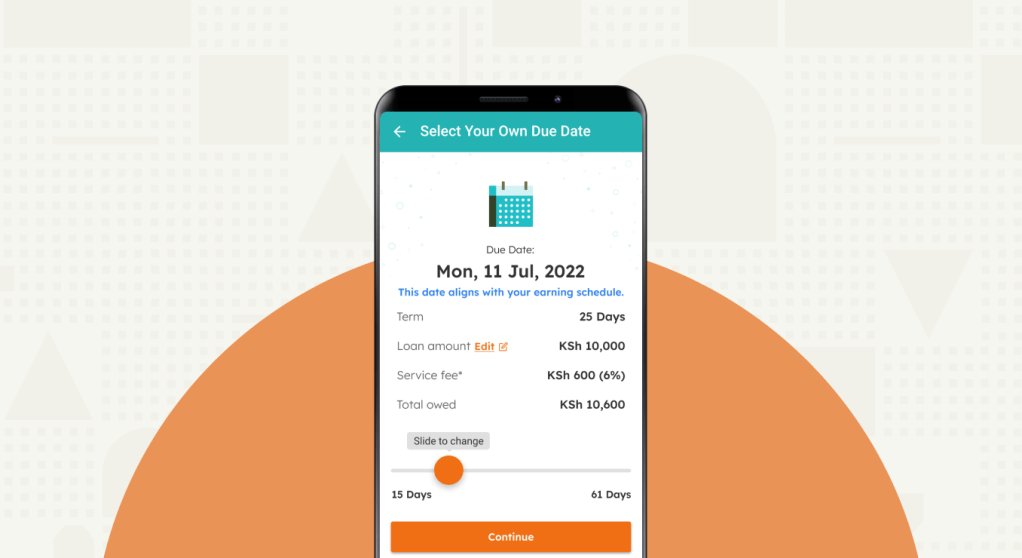

Tala’s new loans are the most flexible loans yet, allowing you to select a repayment date any day between 1-61 days. We enable you to select the date you’d like to repay your loan, so that you can plan ahead, align repayment with your income and expenses, and see what your loan will cost you when you repay on schedule.

Our experience serving millions globally has shown that customers who plan ahead are generally more successful with Tala over the long term. Planning ahead also allows you to set financial goals, track your progress more effectively, and take advantage of moments to save! Here are 5 tips to help set you up for success:

1. Select a date to repay that is near your next pay day. Make repayment easy!

You should always choose a loan amount and select a date to repay that makes repayment as easy and stress-free as possible. When scheduling your loan repayment, we recommend that you plan for when you will realistically have money again.

2. Plan your repayment along with your other financial commitments

Assess when your other predictable financial commitments are due while you select the date to repay your Tala loan. This will help to ensure that you have funds available for repayment and prevent you from overstretching.

3. Select the earliest date that you can realistically repay

Life can be unpredictable, especially when we look far into the future. It may be easier to forecast when you’ll have funds to repay your loan on a shorter timescale, so choosing a due date near your next pay day is usually easier than trying to plan further out. Plus, if you know you can pay back sooner, you can pay less interest!

4. Allow for an extra day or two if you think payday may come late

You want to be as realistic as possible when selecting your loan repayment date. If you are worried that an important income source may have a delay, give yourself a little extra time to make sure that you account for that. Remember that you can alway repay early so that you pay less interest!

5. Work with a budget

Plan and monitor your expenditures. Setting a budget helps you maintain financial discipline and avoid redirecting funds meant for loan repayment to other budget items. Operating within a budget can give you more control over your finances and help you to save!

Whether you rely on Tala on a regular basis to supplement your income and pay your bills or you simply want the security of having quick access to money in case of emergency, Tala is here to help you gain financial stability, security, and peace of mind.

Consistent repayment is the best way to grow your loan limit over time. Your first loan is only the initial stepping stone! When you consistently repay your loans, you will see your loan limit climb higher and higher. We hope these tips for scheduling repayment help you set yourself up for long-term financial growth with Tala!